The new edition of the E-commerce Sectors Report in Brazil brings visitor data from sites and apps, and demographic Share of Search distribution data from across the country.

In July 2022, Brazilian e-commerce grew 5.29%, driven by the Tourism (+14.3%), Cosmetics (+11.9%) and Retail (+6.3%) segments. On the other hand, visits through apps, which had seen strong growth in recent months, rose by 1.53% compared to the previous month.

E-commerce websites and applications combined had 24.3 billion hits over the last 12 months . The data are from the E-commerce Sectors Report in Brazil, published in Portuguese every month by Conversion, an SEO (Search Engine Optimization) agency.

The study also reports the most searched brands in each segment, using the Share of Search methodology, which is predictive in relation to market share, that is, it points out the market share trend of each store. The brands with the highest Share of Search are Amazon (59%, Imported sector), Petz (44%, Pet sector) and Stanley (42%, Gifts & Flowers sector).

“In the last month, Brazilian retail as a whole returned to a scenario of more optimism with growth in brick and mortar stores, and also in Brazilian e-commerce, demonstrating a recovery of the economy”, said Diego Ivo, founder and CEO at Conversion. “The rise in the retail segment reached 6.3% in the last month, one percentage point above the national average, which is extremely positive”, added Ivo.

In July, 74.4% of e-commerce in Brazil accesses were from mobile devices

In July, more than 74% of e-commerce accesses were from mobile devices. This is an increasingly strong trend, especially with the expansion of fast and mobile internet for all Brazilians. Of the total visits, 20.8% come from apps, 52.8% from website access via mobile and only 26.4% from desktops.

Preferred access to the children’s product sector is by mobile devices, with 82% of total accesses. Only 29% of all accesses to the Food & Beverage sector were via mobile device.

The most visited apps were Shopee (132 million hits), Mercado Livre (77 million) and iFood (50 million). App data is for the Android operating system only.

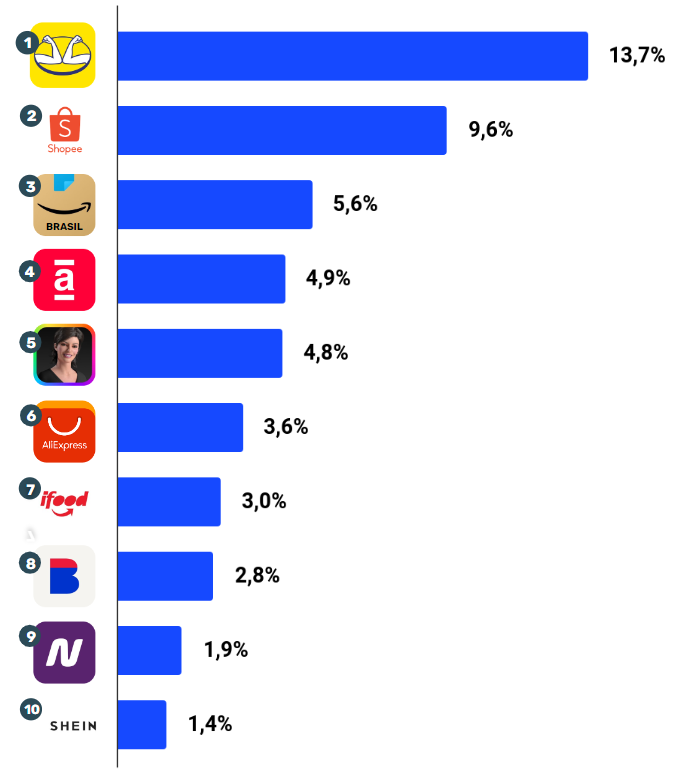

Ranking and Market Share of the 10 largest e-commerce companies in Brazil

The E-commerce Sectors in Brazil Report presents the ranking of the main e-commerces in the country monthly. This ranking is divided into two categories: one for all websites and one for each of the 18 sectors. The Top 10 are: 1. Mercado Livre (13.7%), 2. Shopee (9.6%), 3. Amazon Brasil (5.6%), 4. Americanas (4.9%), 5. Magalu (4.8%), 6. AliExpress (3.6%), 7. iFood (3%), 8. Casas Bahia (2.8%), 9. Netshoes (1.9%) and 10 Shein (1.4%). The percentage refers to market share.

Share of Search and the brands with the highest market share

The Share of Search metric is the proportion of searches for a specific brand within the consumer category in which it operates. The formula for calculating Share of Search is to divide the search volume for a brand by the total search volume for all the brands in a segment. The importance of Share of Search is that, as shown by Les Binet study, it predicts market share.

In our study, we analyzed the Share of Search of all the main sectors of Brazilian e-commerce. In this regard, positions were also exchanged. Amazon remains at the top as the e-commerce with the highest share of searches among all categories, holding 59% of the Imported sector . Continuing the TOP 5 we have Petz (44%), Stanley (42%) and Loja do Mecânico (42%).

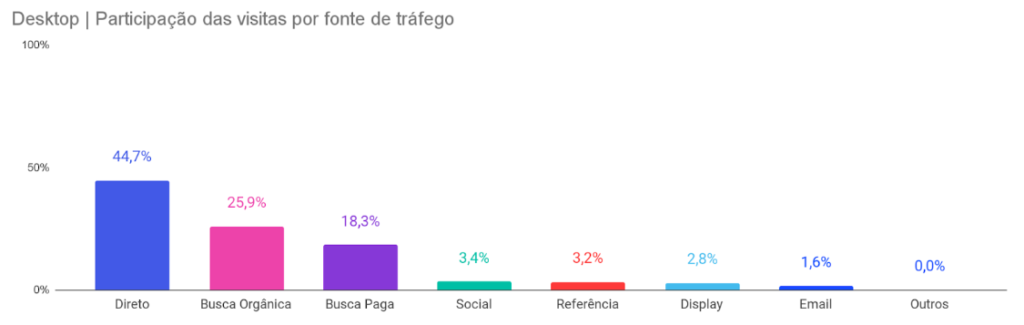

Although search engines are the most important source of traffic, there must be a balance between organic and paid.

Participation in our report and rankings is based on the estimated audience volume of the sites, according to the methodology we present. The audience, in turn, is made up of traffic channels that send visitors to each e-commerce. The main form of entry is the so-called Direct , which is usually when the person types the store address, and adds up to 44.7%.

Soon after, traffic from organic (25.9%) and paid (18.3%) search come in second and third, respectively. We can say that searches are the most important channel for e-commerce , because they reveal consumer intent and channel demand to virtual stores. Even in the virtual stores themselves, the search engine is essential.

And, above all, the important thing is to provide an excellent user experience, making your visitor want to spend time browsing your site, ensuring a greater probability of returning. In addition to traffic and a good experience, it is important to have a robust product mix in your niche, competitive pricing, fast shipping and being a brand loved by consumers. Easy?

Certainly not, but the opportunity is open to everyone!